From “man camps” to mansions, the impact of shale drilling is spilling over into the US residential market. While the rest of the country creeps slowly out of the worst housing bust since the 1930s, the comeback is significantly more robust in some small, formerly stagnant cities like Youngstown, OH; Yorktown, TX; and Williston, ND. As the real estate mantra ”Location, location, location!” suggests, geography is key: each of these towns is benefiting from its proximity to a prolific shale formation.

No Longer the “Shrinking City”

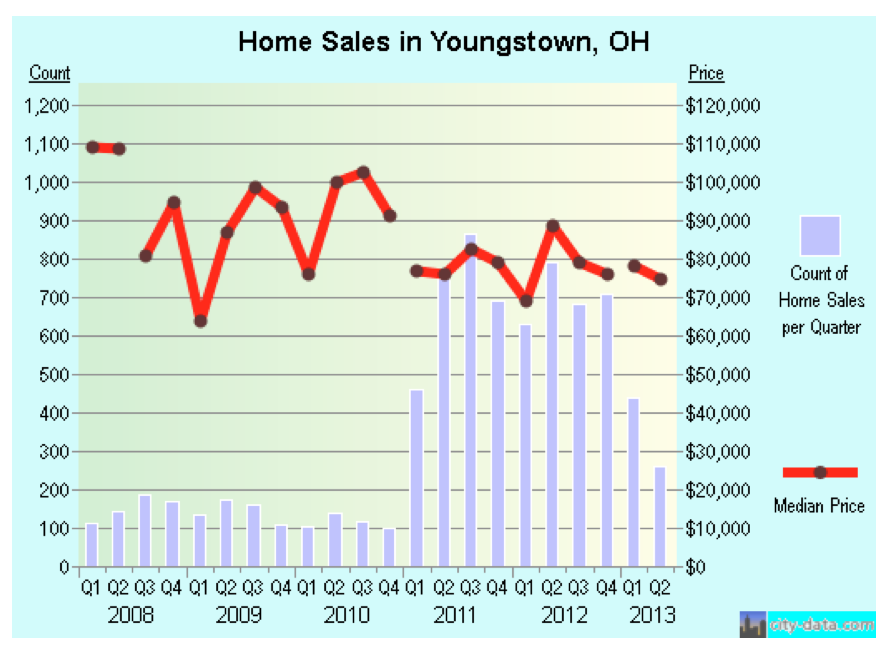

Once a steel boomtown second only to Pittsburgh in total mill output, Youngstown was devastated by the decline of the US steel industry during the latter part of the 20th century. In 2010, the city’s population was less than half what it was in 1950. But with the continuing development of the Marcellus shale, which encompasses 104,000 square miles across Pennsylvania, West Virginia, southeast Ohio, and upstate New York, Youngstown is shedding its reputation as America’s Incredible Shrinking City.