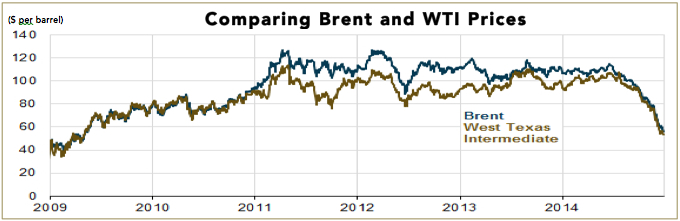

Since 2009, downstream infrastructure in the US has adapted in order to better handle domestically-produced crude. Unfortunately, the rate at which new plants have come online and old plants have been retrofitted has severely lagged behind rising production levels. As a result, the price gap between WTI and Brent has remained, though it has fluctuated somewhat.

What the Brent/WTI Spread Has Done Lately

In recent months, crude prices have been on a downward spiral. Why? For one: the global oversupply of oil – or at least the perception that a global oversupply will exist in the future, most notably in China and India (two of the world’s largest consumers). For another: with OPEC’s decision in November not to curtail production.