Amber waves of grain still dominate much of the rural landscape in North Dakota, a state long known for the production of wheat, corn, soybeans, and barley. But in certain regions, oil rigs are now as likely to dot the horizon as silos, and barrels have become as much a standard measure as bushels.

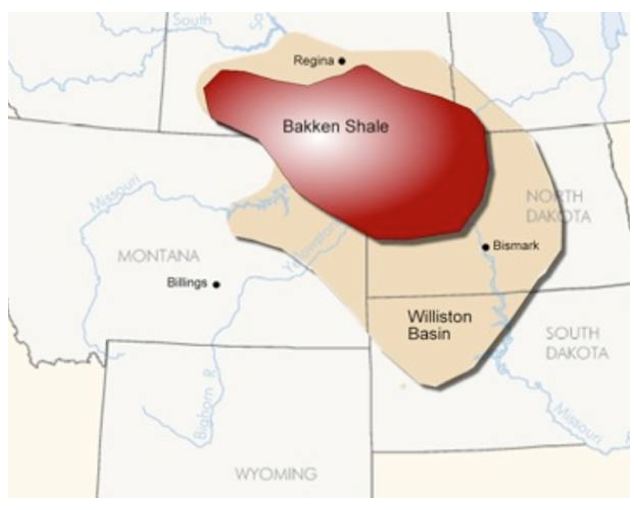

The reason is the 200,000-square-mile Bakken Shale.

Spreading conically from northwest North Dakota into Montana and Canada, the Bakken is, by US Geological Survey estimates, the nation’s largest continuous oil accumulation. Since hydraulic fracturing and horizontal drilling were introduced there in 2007, production has soared to 800,000 barrels of oil daily. That means the Bakken has outpaced Alaska as the country’s number two oil producer. Only Texas is more productive.